Shopping Tax Free In The UK

While the UK has plenty of incredible sights to see, it has become the focal point for the Indian tourists for its extraordinary shopping experiences.

From old rare books to the newest launch of Gucci at the Paris Fashion Week, the UK offers a wide variety of products for those with a taste in shopping.

But the taxes levied on products purchased in the UK can make a huge dent in your overall budget.

Taxes On Shopping In UK

The UK imposes a hefty 20% sales tax on most goods. Imagine £30 going towards taxes on a purchase of £150 product. That’s huge.

However, the deal is made sweet by allowing VAT refund for outside visitors, when you spend at least £30 at one shop.

VAT in the UK is very similar to GST in India.

Are Value Added Taxes Refundable?

Yes. You are bound to pay VAT at the time of store transaction and later eligible to file for a tax refund.

Who Are Eligible For VAT Refund?

Any foreign tourist who is not a resident of the UK or EU can apply for a tax refund.

EU residents are eligible for VAT refund if they were living outside the EU for at least 12 months.

Students and expats are eligible for VAT refund as well.

Are VAT Refunds Applicable On All Products & Services?

VAT refund is allowed on goods you plan to take outside the UK or EU by the last day of the third month after the month you purchased them in.

VAT refund cannot be claimed on service charges such as hotel bills, spa bills, concert tickets, etc. Products purchased online are not eligible for VAT refunds.

VAT refund can be claimed only for products that charges you for VAT. So, goods like staple food, books, children’s goods are not included in the list since they are already tax free.

Note that the receipts will tell you if you have been charged VAT and keep them for later for fact checking.

Purchased goods need to be sealed and unused so that they are available for customs inspection on departure from the EU.

Procedure To Apply For VAT Refund

Step 1 – You can get a VAT refund form (VAT 407) at participating stores. A passport might be required to prove your eligibility for tax refund.

Step 2 – The duly filled form and the purchase receipts needs to be presented at the customs at the time departure for approval. The goods need to be produced in unused condition for verification.

Step 3 – If everything is on order, the customs officer will approve your form.

Step 4 – Finally, you have to take the approved form to the VAT refund counter of the participating store at the airport where you will be informed where your VAT refund will be paid either in cash or refunded to your card that has been used during the purchase.

Disadvantages Of Applying For VAT Refund Through Tax Refund Company

- Massive commissions are charged by refund companies which can go as high as 50%.

- The company might refund you VAT in your preferred currency however you may further lose 10-20% owing to poor exchange rates at the airport.

- Paperwork has to be one by self which might be complex.

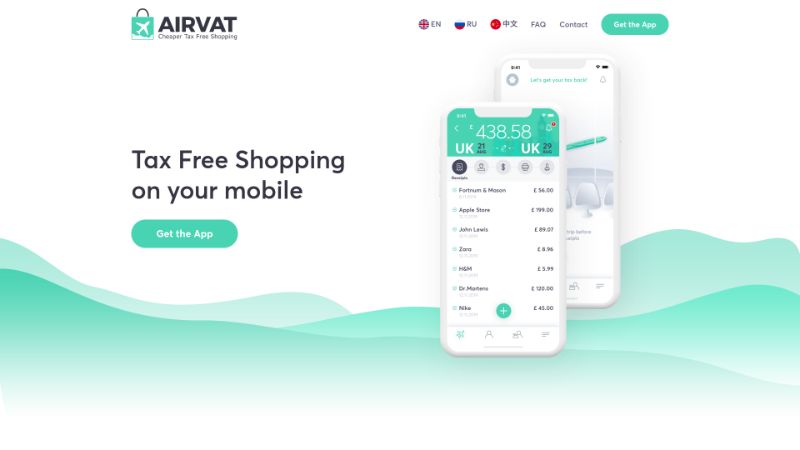

VAT Refund Application Through AirVAT App

You can opt for a digital solution, AirVAT app which takes care of all the back end paperwork for the customers, meaning one less thing to worry about during your travels.

AirVAT app is available for iOS and Android devices.

How To Use AirVAT App

- Take a photo of the purchase receipts and upload them within 14 days of purchase. Do not ask for the tax refund form in the store.

- AirVAT then consolidates all your eligible purchases into one AirVAT tax refund form.

- Print the AirVAT form before you go to the airport and get it authorized by customs.

- That’s it. Your refund will be credited within 2 – 8 weeks of departure.

Advantages Of Using AirVAT App

- When you apply for a UK VAT refund through AirVAT, the minimum spend of £30 is not a prerequisite.

- Commission fee is 20% of the refund amount, which is much cheaper than what the tax refund companies charge.

- No need to do the paperwork manually, saving you time and stress.

- You can choose your preferred payment method to receive your app. Currently Visa, MasterCard, PayPal, WeChat Pay and Bank transfer is possible.

If you have any questions regarding the AirVAT app, please let me know.